Mileage allowance (IREC - 1607)

(2) Mileage allowance shall be calculated by the shortest of two or more practicable routes, or by the cheapest of such routes as may be equally short; provided that the Head of Department or Divisional Railway Manager may, for special reasons which should be recorded, permit mileage allowance to be calculated by a route other than the shortest or cheapest if the journey is actually performed by such route.

(3) If a railway servant travels by a route which is not the shortest but cheaper than the shortest, his mileage allowance shall be calculated on the route actually used.

Note.-(1) The short route is that by which the traveller can most speedily reach destination by the ordinary modes of travelling. In case of doubt, the Head of Department may decide which shall be regarded as the shortest of two or more routes.

(2) In calculating mileage allowance for journeys by road, fraction of the kilometer should be omitted from the total of a bill for any one journey but not from the various items which make up the bill.

(4) A railway servant is required to travel by the class of accommodation for which traveling allowance is admissible to him. If a railway servant travels in a lower class of accommodation, he shall be entitled to the fare of the class of accommodation actually used. In cases, however, in which the Controlling Officer is satisfied that there were sufficient reasons for the railway servant to have travelled by the lower class, he may allow the full mileage allowance admissible for the higher class.

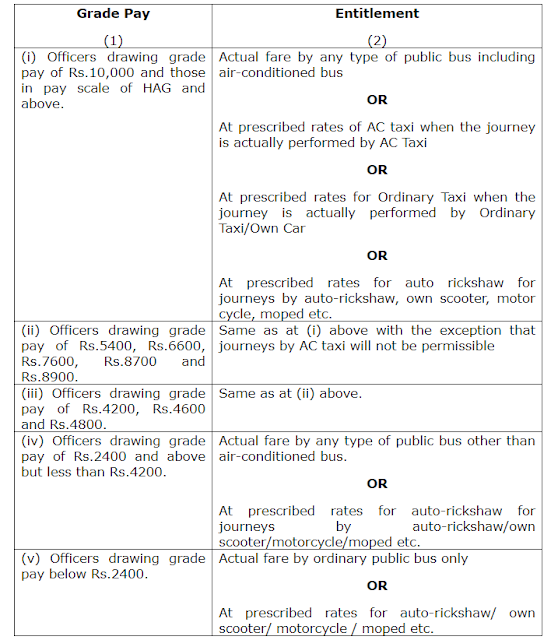

(5) The entitlements for journeys by road, on tour, are as follows:-

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/14dated 1.12.2008 and 23.04.2009 ).

Mileage Allowance for road journeys shall be regulated at the following rates in places where no specific rates have been prescribed either by the Director or Transport of the concerned State or of the neighbouring States:

(i) For journeys performed in own car/taxi............................Rs.16 per Km.

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/14dated 1.12.2008 and 23.04.2009 ).

(ii) For journeys performed by autorickshaw..........................Rs.8 per Km.

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/14dated 1.12.2008 and 23.04.2009 ).

(iii) For journeys performed by auto-rickshaw/taxis under the prepaid charges system managed by local Police/Airport Authority/State Transport Authority in Metropolitan Cities. Reimbursement of fare as determined by the Government agencies

(Authority: Board’s letter No. F(E)I/2004/AL-28/6 dated23.7.2004)

NOTE-1 : Employees in receipt of Grade Pay less than Rs.4200/- are not entitled to travel by taxi or taking a single seat in a taxi. If they travel by taxi/own car, for whatever reason, they will be reimbursed only the actual charge limited to the rates prescribed by the Dte. of Transport for autorickshaw.

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/14dated 1.12.2008 and 23.04.2009 ).

NOTE-2: Journeys performed by autorickshaw/tonga/cycle-rickshaw/man-driven rickshaw may be equated to those performed by scooter/motor cycle and road mileage may be allowed accordingly, For journeys on bicycle/foot, the road mileage will be at the rate of Rs.1.20 per kilometer.

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/14dated 1.12.2008 and 23.04.2009 ).

NOTE-3: As actual bus fare is admissible under these orders, there will be no increase in the above rates of road mileage in the case of journeys performed in hill tracks.

(Authority: Railway Board’s letter No.F(E)I/98/AL-28/9 dated 24.4.1998 &12.3.99)

Note-4: The rate for Mileage allowance for road journey by taxi/own car/auto rickshaw/own scooter/tonga/cycle rickshaw/man-driven rickshaw/ bicycle/foot shall automatically increase by 25% whenever Dearness allowance payable on the revised pay structure goes up by 50%.”

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/14dated 1.12.2008 and 23.04.2009 ).

IRCE 1608. The point in any station at which journey is held to commence or end is the railway station, provided that a journey on transfer shall be held to begin and end at the actual residence of the railway servant concerned.

Government of India’s decisions

(1) A Railway servant who resides away from his headquarters, will, on transfer, be eligible for transportation charges for personal effects at prescribed rates from his residence to the nearest Railway Station at the old headquarters and from the Railway Station to the actual residence at the new headquarters.

(Authority:- Railway Board's letter NoF(E)I/98-AL-28/10(A)dated 1.5.98)

(2) In admitting Travelling Allowance claims, the mileage between the two stations as indicated in the ‘Railways Fare & Time Tables’ should be adopted.

(3) In cases of claims where the distance between the places shown in the Fare & Time Table is exactly 8kms., although the actual distance as shown in the ‘Working Time Table’ between the same places exceeds 8 kms., the Travelling Allowance claimed should be passed with reference to the actual distance shown in the Working Time Table.

(4) In the case of employees proceeding on tour, road mileage at the prescribed rates will b e admissible from duty point/residence at Headquarters to railway station/airport/bus stand and vice-versa depending upon the points between which journey is performed and between the Railway Station/Airport/Bus-stand and the duty point at the outstation.

(5) Road Mileage Allowance in terms of Govt. of India’s Decision No. (4) above will be admissible only if the amount is actually spent by the Railway servant while performing journey on duty. Railway servants who are given Free Residential Card Passes/monthly Season tickets/Railway Passes to perform the journey from their residence to their headquarters station, will not be entitled to any Road Mileage Allowance when they perform a journey on duty on the Free Residential Card Pass/Monthly Season Ticket/Railway Pass etc. They will, however, be eligible for the Daily Allowance as admissible under the Rules.

(Authority:- Railway Board's letter No. F(E)I/92/AL-28/4 dated 18.2.93)

(6) For determining the ‘duty point’ the following provisions may be observed: -

(i) Duty point at the headquarters will mean the place or office where a railway servant remains on duty i.e. the place/office of employment at the headquarters.

(ii) At outstations the ‘duty point’ shall be taken to be the place/office visited by the railway servant on duty. Where there are two or more such points at an outstation, the following shall be taken as the ‘duty point’: -

(a) If the railway servant reaches that station by rail, sea or air, the point which is farthest from the Railway Station, harbour or jetty or the airport as the case may be, and

(b) If he reaches that station by the road, the point which is farthest from the point where the journey to that station commenced.

(iii) The General Manager may fix ‘duty point’ at the Zonal Headquarters office in consultation with the FA&CAO and if necessary they may also consult the Accountant General, headquartered at the Zonal Headquarters of the Railway. The ‘duty point’ may also be fixed for the Divisional Headquarters and other offices by the General Manager in accordance with the above guidelines.

(iv) Road-mileage will be admissible only when the Government vehicle is not provided when a railway servant is proceeding on tour/duty.

No comments:

Post a Comment