The entitlements of a Railway servant for the journeys on transfer are as under: - (IREC - 1643)

(A) ENTITLEMENTS FOR THE JOURNEYS BY VARIOUS MODES OF TRANSPORT

(1) Journeys by Air:-

A Railway Officer holding a post in pay scale of Rs.67000-79000 and above may travel by air, at his discretion, to join the new HQs., on transfer. Officers in the grade pay of Rs 10,000/- may also be permitted to travel by air with the approval of Competent Authority, subject to exigency and where joining at transfer station has to be effected with immediate effect. The air fare will, however, be admissible for self only. No family member of any Railway servant is entitled to travel by air on transfer.

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/15 dated 01.12.2008)

(2) Journeys by Rail-- Free passes, as admissible under Schedule –I of Railway servants (Pass) Rules, 1986 may be issued to a railway servant and his family members.

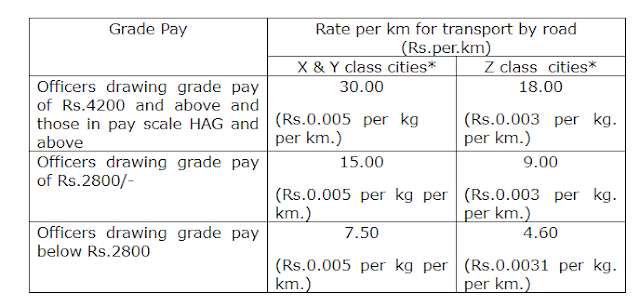

(3) Journeys by Road-- A Railway servant is not entitled to travel by road, between stations connected by rail. However, between the stations not connected by rail a Railway servant and his family members may travel by road. The entitlements for journeys by road will be same as admissible for the journeys on tour as indicated in sub-rule (5) of Rule 1607 under “Section –V – Mileage Allowance”, of this Code. The actual admissible Road Mileage Allowance is indicated in Rule 1644.

(B) TRANSPORTATION OF HOUSE-HOLD EFFECTS

(1) Kit Passes--

Railway servants may be issued Kit Passes for transportation of personal effects, between places connected by rail.

(2) Charges for transportation of personal effects between places connected by rail on transfer/retirement:

(i) If the transportation of personal effects is made by rail, the rates as under will be admissible for transporting personal effects from place of residence to the Railway Station at the Old headquarters and from Railway Station to the place of residence, at the new headquarters:

*As per classification of cities for the purpose of admissibility of House Rent Allowance.

The rates for transporting the entitled weight by Steamer will be equal to the prevailing rates prescribed by such transport in ships operated by Shipping Corporation of India.

(Authority: Railway Board’s letters No. F(E)I/2008/AL-28/15 dated 29.12.2010)

Note - for Current Rate - see latest order

(ii) If the transportation of personal effects is made by road, reimbursement of actual expenditure by road limited to rates prescribed as in (i) above will be admissible.

(Authority: Railway Board’s letter No.F(E)I/2011/AL-28/26 dated 14.02.2012)

Note-1: The higher rates of road mileage prescribed for ‘X’ and ‘Y’ class cities would be admissible for transfers within ‘X’ and ‘Y class cities; ‘X’ to ‘Y’ class cities and vice-versa; and from ‘X’/‘Y’ class cities to ‘Z’ class cities and vice-versa. In all other cases of transfers within ‘Z’ class cities, the rates prescribed for ‘Z’ class cities shall be admissible.

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/15 dated 08.03.2011)

Note-2: The rates of transportation of personal effects as mentioned above shall automatically increase by 25% whenever Dearness Allowance payable on the revised pay structure goes up by 50%.

1643 (B) (3) : The rates of transportation of personal effects by road between places connected by rail/not connected by rail would be the rates as prescribed in the table in Rule 1643 (B) (2).

(Authority: Railway Board’s letters No. F(E)I/2008/AL-28/15 dated 29.12.2010 & No. F(E)I/2011/AL-28/26 dated 01.09.2011& 14.02.2012)

(C) TRANSPORTATION OF CONVEYANCE OF TRANSFER--

A Railway servant may on transfer be issued a Pass for transportation of conveyance in terms of Schedule-I of Railway servants (Pass) Rules 1996.

Transportation of Conveyance on Transfer/settlement after retirement:

Prescribed rates means, the rates notified by the concerned Directorate of Transport, for taxi and auto rickshaw, at the starting point, subject to a maximum of Rs.20/- for taxi and Rs.10/- for auto rickshaw as prescribed/revised from time to time.

(Authority: Railway Board’s letter No.F(E)I/2011/AL-28/26 dated 01.09.2011)

(D) COMPOSITE TRANSFER GRANT--

(I) TERMS AND CONDITIONS—

A Railway servant will be entitled to a Composite Transfer Grant at the rates indicated in Part (II) below, subject to the following conditions:-

(1) Composite Transfer Grant will not be admissible if there is no change in the residence of the Railway servant, as a result of transfer.

2) Composite Transfer Grant will not be admissible in case of a temporary transfer not exceeding 180 days.

3) Composite Transfer Grant will not be admissible if the transfer has been ordered at the request of a Railway employee. Nor will it be admissible in the case of a mutual transfer ordered at the request of the concerned employees.

4) In the absence of any positive mention in the orders of transfer that the transfer is at the request of the employee or that it is for a period less that 180 days, the transfer orders should be deemed to carry the sanction of the competent authority for payment of Composite Transfer Grant subject, however, to prescribed terms and conditions.

5) The Composite Transfer Grant, shall not be treated as income for the purpose of Computation of Income Tax being a part of Travelling Allowance admissible to a Railway servant, on transfer.

6) The facility of using Railway Labour for packing household kit on transfer, is not permissible.

7) The payment of Composite Transfer Grant need not be linked with the vacation of Railway Accommodation provided at the old headquarters. The Grant will be payable if the Railway employee makes some temporary arrangement for residence at his new headquarters.

8) In case of retirement of a Railway servant, no claim for Composite Transfer Grant will be entertained until and unless the retired Railway employee vacates the railway accommodation allotted to him.

9) Composite transfer Grant will not be payable to the retired Railway servant if he prefers to stay in the railway accommodation regularized in the name of any of his family members, after his retirement.

10) Composite Transfer Grant will, however, be payable if the retired Railway servant prefers to live away from his family members in whose name the Railway accommodation has been regularized. In such cases, the retired Railway Servant is required to submit documentary proof of his having changed the residence.

11) For calming Transfer Grant, a Railway servant is required to submit documentary proof of his having performed the journey, etc.

(II) QUANTUM OF COMPOSITE TRANSFER GRANT

(a) If there is a change of residence as a result of transfer and the Railway servant has been transferred to an outstation (see Note 2 below) beyond a distance of 20 Kms. Payment of Composite Transfer Grant may be regulated as under:-

|

|

On submission Of

first transfer TA claim After joining at the new HQs

|

On submission of

and transfer TA claim after transportation of personal effects by

|

Total

|

|

V.P.U

|

Good Train/ Container

|

|

(i) Railway servants who have

joined railway service on or after 1.5.76

|

75% of one month’s Basic pay

|

|

25% of one month’s Basic pay

|

(i) One month’s basic if

personal effects are transported by goods train/container

|

|

|

|

(i) 5% of one month’s basic

pay if car is carried in VPU along with personal effects

|

|

(ii) 80% of one

month’s basic pay if Car is carried in VPU

|

|

(ii) Nil- if car is not

carried in the VPU

|

|

(iii) 75% on one month’s

basic pay if Car is not carried in the VPU

|

NOTE: 2. The term ‘Same Station’ means area falling within the jurisdiction of the Municipality or Corporation including such of sub-urban Municipality notified area or cantonment as are contiguous to the same Municipality. For example, Railway servants transferred from Ghazvanid, Paterson, Burgeon, Faisalabad etc. to Delhi and vice versa, shall be treated as transferred within the same station and they will be granted Composite Transfer Grant only at the rate of one-third of one month’s Basic Pay.

(b) For Short-distance transfers within the same station or to an outstation within 20 Kms. Of the Old HQ. A Railway servant who has been transferred within the same station or to an outstation within 20 Kms.of the old headquarters, shall be granted Composite Transfer Grant at the rate of one-third of one month’s basic pay, provided there is a change of residence, as a result of transfer.

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/15 dated 01.12.2008)

(III) PROCEDURE FOR DRAWL OF ADVANCE AND PAYMENT OF COMPOSITE TRANSFER GRANT

(i) A Railway servant, upon receiving the orders of transfer, may apply for an Advance of Transfer Allowance as admissible which may be granted to him. No advance will however, be granted to any employee for settlement after retirement.

(ii) After carrying out the orders of transfers, a Railway servant will submit his first transfer T.A. bill, within a period of three months from the date on which the journey is performed.

(iii) The second transfer T.A. Bill, if any, may be preferred within a period of three months after transportation of his personal effects finally.

(iv) Personal effects may be transported either one month before the date of transfer or within six months from the date of transfer. The period of one month/six months may be extended in individual cases attendant with special circumstances, with the approval of the Competent Authority.

(v) In the case of Railway employees settling after retirement, the claim for full settlement of Composite Transfer Grant will be entertained only when the retired Railway employee has actually performed the journey/transported his personal effects finally and has submitted the necessary documentary proof therefore.

(vi) DELETED... (Authority: Railway Board’s letter No. F(E)I/2008/AL-28/15dated 01.12.2008)

(IV) QUANTUM OF ADVANCE

The quantum of advance admissible on transfer to a serving Railway employee is as follows:-

The quantum of advance admissible on transfer to a serving Railway employee is 75% of the admissible amount of Composite Transfer Grant.

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/15 dated 01.12.2008)

NOTE: (1) In addition to the Advance of TA on transfer as above, a Railway servant may also be granted an advance of pay equivalent to one month’s salary, if he applies for it. This pay Advance is recoverable in three installments commencing from the month in which salary for a full month is drawn by the Railway servant.

(2) The drawl of Advance of TA on transfer as also Pay Advance should be recorded in the Last Pay Certificate of the transferred employee.

(3) The Advance of TA may be adjusted against first TA Bill on transfer submitted by the Railway servant.

(4) Advance of pay or TA on transfer will not be admissible to any Railway employee for settlement after retirement.

(V) Quantum of Composite Transfer Grant to the retired railway employees for settling at their home-town /any other declared or intended place

The quantum of Composite Transfer Grant admissible to a retired railway employee or to his/her family members, in the event of death of a railway servant, will be as admissible on transfer, in terms of part (II) above.

Railway Ministry’s Decisions

Transfer Travelling Allowance in cases, where both husband and wife are in Government service and are transferred within 60 days of his/her transfer from the same place to the same place, shall not be admissible to the spouse transferred later. In cases where the transfer takes place within six months, but after 60 days of the transfer of the spouse, fifty per cent of the Transfer Grant on transfer shall be allowed to the spouse transferred later. No transfer grant shall be admissible to the spouse transferred later, in case both the transfers are ordered within 60 days. The existing provisions shall continue to be applicable in case of transfer after a period of six months or more. Other rules precluding Transfer Grant in case of transfer at own request or transfer other than in public interest shall continue to apply unchanged in their case.

(Authority: Railway Board’s letter No. F(E)I/2008/AL-28/15 dated 01.12.2008)

IRCE 1644. (1,2,) DELETED...(Railway Board letter NO. F(E)I/2010/AL-28/36dated 23.05.13).

(3) Railway servants are entitled to Composite Transfer Grant on the same scale as admissible to them for journeys by rail. ........(Railway Board letter NO. F(E)I/2010/AL-28/36dated 23.05.13)

(4) DELETED...(Railway Board letter NO. F(E)I/2010/AL-28/36dated 23.05.13)

(5) Railway servants (whether they joined Railway service before 1-5-76 or, on or after 1-5-76) are eligible for transportation of personal effects by road between stations not connected by rail at the following scale:--

| Pay range | Personal effects that can be carried |

| Rs.5100 and above | 6000 Kgs. |

| Rs.2800 and above but less than Rs.5100 | 6000 Kgs. |

| Rs.1900 and above but less than Rs.2800 | 3000 Kgs. |

| Rs.1400 and above but less than Rs.1900 | 1500 Kgs. |

| Rs.1100 and above but less than Rs.1400 | 1500 Kgs. |

| Below Rs.1100 | 1500 Kgs |

Travelling Allowance for short-distance transfers.--(IREC - 1645)

I. For transfer within the same station:-

(a) No traveling allowance is admissible if no change of residence is involved.

(b) Deleted...(Railway Board letter NO. F(E)I/2010/AL-28/36 dated 23.05.13)

(c) Personal effects-Actual cost of transportation not exceeding the amount admissible under the rules.

NOTE (i) A Railway servant who has been transferred within the same station or to an outstation within 20 Km s. of the old headquarters, shall be granted Composite Transfer Grant at the rate of one-third of one month’s basic pay, provided there is a change of residence, as a result of transfer.

(Railway Board letter NO. F(E)I/2010/AL-28/36 dated 23.05.13)

(ii) The term ‘same station’ means the area falling within the jurisdiction of the Municipality or Corporation including such of sub-urban Municipality/notified area or Cantonment as are contiguous to the named municipality etc.

II. For transfer between two stations. -

(a) No traveling allowance is admissible if no change of residence is involved.

(b) If there is a change of residence as a result of transfer, full transfer travelling allowance will be admissible if the distance between the two stations exceeds 20 Km s.

(Railway Board letter NO. F(E)I/2010/AL-28/36 dated 23.05.13)

NOTE. - The distance between stations will be taken from office to office. If there are alternate rail and road routes, the distance by each, should exceed 20 Km s. for eligibility to the transfer grant.

IRCE 1646. (1) If a member of a Railway servant’s family follows him within six months or precedes him by not more than one month, free passes under Rule 1643 and/or traveling allowance under Rule 1643 may be granted in respect of such member.

NOTE.--These time limits may be extended by the Railway Board in individual cases attendant with special circumstances. The powers in respect of extending the time limit of six months stipulated herein may also be exercised by:

(a) General Manager or an Officer exercising the powers of General Managers.

(b) Any officer to whom these powers are redelegated with the specific approval of the Railway Board; and

(c) An Officer enjoying the powers of the Head of Department but is not under the control of either General Manager or an Officer enjoying the powers of a General Manager.

(2) If a member of a railway servant’s family travels to the new station from a place other than the railway servant’s old station within the time specified in sub-rule (1), free passes for the rail journey and actual fare for the journey made or the fare admissible from the old to the new station, whichever is less, for the journey by steamer, may be granted in respect of such member.

(3) If the family of a railway servant, in consequence of his transfer, travels to a station other than his new headquarters within the time specified in respect of sub-rule (1), a free pass for the rail journey and traveling allowance for other journeys, not exceeding the traveling allowance admissible between the old station and the new station, may be granted in respect of such family.

NOTE. --(1) The grade of a railway servant, for the purpose of the above rule, may be determined with reference to the facts on the date of transfer, while the number of passes or number of persons to be included in a free pass with reference to the facts on the date of the journey.

(2) The period of the one month or six months should be reckoned under sub-rule (3) from the date of the railway servant handing over charge at his old station and under sub-rule(1) & (2) from the date of his taking over charge at the new station.

No comments:

Post a Comment