RETIREMENT BENEFITS

1. Pension

2. Gratuity

3. P F

4. NGIS

5. Commutation

6. Leave Salary

7. Post Retirement Complimentary Pass

8. Composite Transfer Grant

9. RELHS (Retired Employee Liberalized Health Scheme) Click Here):

10. Retention Of Railway Quarter

11. Regularization Of Railway Quarter

12. Kit Pass

13. Settlement Pass Etc.

14. New Pension Scheme

15. Fixed Medical Allowance: Click Here

16. Pension Adalat - Click Here:-

PENSION

a) All non- pensionable railway servants who are in service on 15.11.1957 & who elect to come on to this rule, option extended from time to time.

b) All persons entering Railway service on or after 16.11.57 except those whose terms of appointment provide to the contract.

c) All CPF beneficiaries in service on 1.1.86 should be deemed to have come over pension scheme on that, unless they specifically opt out to continue under the CPF scheme.

Kinds of pensions:-

1. Superannuation pension.

2. Retiring pension

3. Invalid pension

4. Compensation pension

Superannuation pension: -

This pension is granted to a Railway servant in case of retirement on Superannuation i.e. on attaining age of 60 yr.

Retiring pension: -

This pension is granted in case of retirement on completion of 30 yr. Qualifying services or attaining age of 55 yr. under FR 56,Rule 2405 (on attaining 50 yr. of age in case of officers appointed prior to age of 35 yr.) & such staff who Retires on Voluntary on completion of 20 yrs service.

Invalid pension: -

This pension is awarded to an employee on retirement due to any bodily or mental infirmity, which permanently incapacitates him for the services. Invalidation should be on medical ground and not due to the irregular or intemperate habits.

Compensation pension: -

This pension is granted to an employee who is discharge from service owing to abolition of a permanent post unless he is appointed to another post the condition of which are deemed to be at least equal to that of his old post.

Employee will be eligible for pension completion of 10 years qualifying service. Pension shall be calculated at 50% of average emoluments or Last Pay which ever is more (w.e.f 02.09.2008)

(RBE No: 112/2008 dt. 15.9.08)

Average emoluments: -

The term emolument means basic pay, which the Railway servant was receiving immediately before his/her retirement.

55% of pay for running staff, 30% of py for LI’s & 25% of pay for Doctors should be taken into account. Average emolument shall be determined with reference to emolument drawn by a Railway servant

during last 10 months of service.

If during last 10 months of service, the Railway servant is absent from duty or on extraordinary leave or has been under suspension, the period whereof does not count as service, the aforesaid period should be disregarded in the calculation of average emoluments & an equal period before 10 months being included. The stagnation increment should be treated as pay.

Qualifying Service: -

A. Total service in years, month & days

Less

B. i) Underage service

ii) Apprentice service.

iii) Leave without pay (other than medical certificate)

iv) Strike.

iv) Strike.

v) Substitute service

vi) Suspension

C. Weightage of max. 5 years in case of voluntary retirement or retirement due to medical unfit has been abolished in 6 th P.C dt.18.02.09)

D. 50% of MRCL service.

Net qualifying service = (A-B)+C

With effect from 22.2.83 Group ‘C’ & ‘D’ employees who are required to undergo departmental training before they are put on regular employment, training period may be treated as qualifying service for pension if training is followed immediately by appointment.

Or

50% of last pay whichever is more.

Minimum Rs.3500/- + Relief

Maximum 50% of highest pay Rs.90,000/- of Cabinet Secretary.

The amount of pension finally calculated should be rounded off to the next higher rupee.

As per 6th P.C recommendation, all employees who Retired on or after 1.1.2006, the full benefit of 33yrs. Qualifying service in case of Pension has been dispensed with. The employee with 20 yrs. Service will

get 50% of last Pay or 10 months emolument which ever is more.

(RBE No: 112/08 dt. 15.09.08) & ( RBLNo: F(E) 2008/PN1/13 dtd. 15.1209)

ADDITIONAL QUANTUM OF PENSION

As per recommendation of 6 th P.C the concept of Additional Quantum of Pension has been Introduced to the Retired Rly. Employees/ widow who will be paid additional % of pension to old Pensioner subject to reaching to the particular age which is as below.

( RBE No: 105/2008 dt. 08.9.08)

CONSTANT ATTENDANT ALLOWANCE

The scheme of constant attendant allowance has been introduced to such Pensioner who are drawing Disability Pension for 100% disability which attributed to or aggravated by service & who require the service of Attendant for at least 03 months. The allowance will be paid @ Rs. 3000/- pm only & no DA ispaid in the allowance along with the Pension subject to submission of declaration form.

The Allowance shall not be paid during the pensioner is inpatient in Hospital.

( RBE No: 112/08 dt.15.9.08, 149/08 dt. 10.10.08 & 72/09 dt. 29.4.09)

Family Pension :- The scheme of family pension is in force of 1.1.64 The families of the Railway servant who appointed on & after 1.1.64 & opted for family pension shall be entitled for family pension.

The family pension will be admissible to widow/widower and in case widow/widower is not available. Unmarried Son up to the age of 25 yrs. Who are not Serving. In case of Daughter till she marries which ever is earlier. After attaining the age of 25 yrs the family pension to son shall only be admissible in case they are handicap mentally or physically & are unable to earn their leaving subject to certain condition.

wef 1.1.98 the parents (father/mother) of deceased employee are also entitled for family pension when no widow or children left by the deceased . For this the income of parents from all source should not be exceed 2550/- pm.

wef 1.1.98 the parents (father/mother) of deceased employee are also entitled for family pension when no widow or children left by the deceased . For this the income of parents from all source should not be exceed 2550/- pm.

In case the Family pension has been allowed in the equal portion , If any one become ineligible due to any reason his share will also be paid to other one.

(RB LNo. F(E)/11/85/PN/1/1 DT. 30.05.89)

The physically handicap/mentally retarded and dependent wards of railway employees, who are having no income, will be allowed Family pension till they survive. On production of necessary certificate issued from medical officer of senior Divl. Medical Officer level.

As regards widow/ Legally divorced daughter who are totally dependant on Rly. servant, the family pension shall be admissible subject to fulfilling of conditions.

Family Pension in case of missing person :-

Considering the great hard ship is being experienced by the family members of Missing person in getting family pension because the death of such missing person is confirmed after the a period of 7 years . This is based on section 108 of the Indian evidence Act, as such to avoid hard ship to the family the Rly. Board

vide LNo. F(E)111/86/PNI/17 OF 19.09.86, 27.03.91 & 21.01.96 has decided as under .

The Govt. employees Kidnapped by Insurgents Terrorists may be sanctioned pension after a period of 06 months from the date of registration of FIR with the police, as concern to payment of gratuity, the earlier instruction will apply.

(RBLNo: F(E)II/2001/PN1/7 dtd. 30.04.2009)

On receipt of the copy of the FIR Lodged with Police the railway administration should paid the amount at balance of the provident fund account of the missing person. The Payment of leave encashment & his salary if due immediately. In case of SR PF optee. The government contribution should be detained only self contribution in provident fund to be paid. After one year from the date FIR lodged with police other benefit viz death gratuity , family pension, and government contribution of the provident fund if exists as regards the calculation of death gratuity it is mention that the same will be calculated as a case of death but pay went will be made assuming the missing person retired .The difference of death gratuity & Retiring gratuity will be made on confirmation of death of the missing person or after a period of 07 years however for relaxation of one year can be forwarded to Rly Board as per instructions contained in RB No. F(E)/II/2001 PNI/28 Dt. 28.09.04 RBE No. 212/2004.

The payment of Group Insurance Scheme will however be made after 7 Yrs though his date of due retirement comes earlier.

Before making all above payment in case of missing employee. The indemnity Bonds will be obtained from the family members.

No Payment on account of deposit link insurance will be admissible in case of missing person.

Rate of the Family Pension admissible

Presently the family pension is admissible at the rate of 30% of the last pay drawn plus G.P admissible there on subject to the minimum of Rs. 3500/- pm + Relief & maximum of Rs. 27000/-.

Enhance Family Pension

Enhance family pension is admissible to the family of the deceased employee who dies with 10 years of qualifying service it will however be admissible for eligible person of the family at the enhanced rate form date of the death of the deceased for a period of 10 year or the deceased would have attains the age of 70 yrs which ever is earlier. In case of Retired employee the Enhanced pension to the widow will be eligible for a period of 07 yrs. or 67 yrs. of age which ever is earlier.

The enhanced rate will be admissible at the double rate of normal family pension but should not exceed the original pension of the deceased and should not be less than 50% of the last pay.

( RBE No: 112/2008 dt. 15.09.08)

GRATUITY

Retirement gratuity shall be paid on retirement Railway servant who has completed 5 years qualifying service shall be eligible for retirement gratuity equal to ¼ of his emolument for each completed six monthly period of

qualifying service.

Emolument means last Pay drawn + GP plus DA

Maximum 16 ½ month’s pay.

Maximum amount Rs.1000000/- ( Ten Lakh)

Benefit of 55% to running staff 30% to Loco Inspectors & 25% to doctors shall be given in basic pay.

Amount of retirement gratuity finally calculated shall be rounded off to next higher rupee.

DEATH GRATUITY

In the event of death in harness of all permanent & temporary Railway servant while in service the death gratuity shall be paid to family members as under.

Max: - 33 times of emoluments

Maximum amount Rs.1000000/- ( Ten Lakh )

Emolument means last pay drawn plus DA benefit of 55% to running staff 30% to Loco Inspectors & 25% to doctors shall be given in basic pay.

Amount of death gratuity finally calculated shall be rounded off to next higher rupee.

LEAVE SALARY

The benefit of encashment of balance LAP at the time of retirement or death while in service shall be granted subject to maximum of 300 days. The leave salary shall be calculated on the basis of last pay grown plus DA.

Consequent upon the decision taken by the Govt. on the recommendation of 6th CPC relating to encashment of leave in respect of both LAP & LHAP shall be considered subject to over all limit of 300 days. The cash equivalent payable for LHAP shall be equal to leave salary as admissible for LHAP + DA without any reduction on Account of pension or other retirement benefits payable.

The orders shall take effect from 01/09/2008.

(RBE 148/2008 dtd. 08/10/2008)

It has been decided to modified the date of effect of encashment of LHAP from 01/09/2008 to 01/01/2006. The benefit will be now admissible in respect of past cases on receipt of applications to that effect from the pensioners concerned.

(RB L.No.F(E)III/2005/PN 1/12 dtd. 23/11/2009)

PF

In case of pension optee, the employee shall get his own contribution to PF & interest thereon. The present rate of interest is 8% p .a ( 2008-09)

(RBE No: 181/08 dt. 18.11.08)

GROUP INSURANCE SCHEME 1980

This scheme being good social security without paying any insurance premium introduced on Railway vide R.B.LNO- PC-III-80/GIS/1 of 21.11.1980. This scheme provides twin benefits of insurance in the event of death while in service & lump sum payment on retirement on monthly subscription of Rs.15/-, 30/-, 60/-, 120/- with insurance cover of Rs.15,000/- Rs.30,000/- Rs.60,000/- & Rs.1,20000/- respectively.

Monthly subscription is divided in to two part i.e. Insurance Fund & Saving fund at the rate of 30% & 70% respectively.

In case on employee died on the date of superannuation the benefit under the Group Insurance Scheme 1980 would be applicable.

COMMUTATION OF PENSION.

A Railway servant shall be entitled to commute for lump sum payment up to 40% of his pension. A fraction of pension to be commuted result in fraction of rupee, such fraction rupee shall be ignored for the purpose of commutation.

An employee who applies for commutation of pension within year of the date of his retirement on superannuation or on voluntary retirement (i.e. before next birth date) will not be subjected to medical examination.

Employee will be eligible for lump sum payment of commutation as per table revised in 6th CPC with reference to date on which commutation becomes absolute.

Commutation table at each birth year of age.

As per 6th PC , the Commutation value for a Pension of Re. 1/- per annum has also been revised. ( RBE No: 112/08) The present value for staff Retiring on Superannuation, ( 60 yrs.) (but the value of next year of

retirement is calculated i.e 61 yrs) is 8.194 x 12= 98.378

Maximum 40% of the pension can be commuted & only once in entire life & the relief (DA) on pension is paid on Total Pension including Commuted value.

Commutation without Medical Examination.

1. Superannuation pension.

2. Retiring pension.

3. Compensation pension.

4. Pension on absorption in public sector undertaking

5. Pension granted on finalization of department, judicial proceeding & issue of final orders thereon.

The employee has to appear for medical examination on completion of one year after retirement. The period of one year shall be reckoned from date of retirement for item 1 to 3, & date of issue of final orders for S.No. 5 .

Commutation after Medical Examination.

1. Invalid pension

2. Compulsory Retirement as a measure of penalty.

3. Compassionate allowance.

4. In case of commutation without Medical Examination if application not received by head of the office within one year.

If fraction of rupee exist in finally calculated amount it should be rounded off to next higher rupee.

The pensioners commuted portion will be restored on expiry of 15 years

from date of commutation.

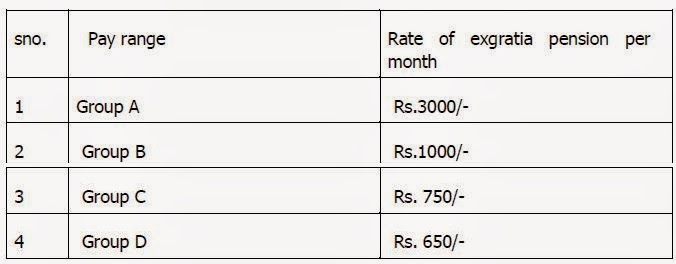

Ex Gratia Pension :- The SRPF optee employee those who were drawing pay up to Rs. 500/- pm & retired on 20 years QS prior to 01.04.57 are eligible for ex -gratia pension as per following revised scale wef 01.1.2006

( RBE No: 65/2009 dt. 17.04.09)

Ex -gratia Payment :- The widow & eligible family members of the SRPF optee employee are eligible for this ex -gratia payment at the rate of Rs.150/- pm + DR . further this rate of ex -gratia payment has been revised at the rate of Rs. 605/- + DR wef 01.11.97

For getting this ex -gratia payment the widow or family member should have applied on the prescribed Performa with death certificate of the employee & any other documents which proves the employment of the deceased employee. The family of employee who resigned or those who have been removed or dismissed are not entitled to get this payment.

The PF optee alive employee those who have retired between 01.04.57 to 31.12.85 with 20 years & more continuous service & also they were not removed / Dismissed nor resigned from service are entitled for ex -gratia payment of 01.11.97 at the rate of Rs. 600/- pm + Relief wef 01.04.04 . This amount is also admissible at the rate of 600/-+300/- = 900/- . The ex -gratia dearness Relief will be allowed @54% wef 1.07.08 & 64% wef 1.1.09, 73% w.e.f. 01.07.2009

(RBE No. 83/2004) & ( 65/2009 dt.17.4.09 )

New Pension Scheme - 2004

The employee recruited in to Rly. service on & after 01.04.2004 will be governed by this scheme . The 10% amount of the ( basic pay +dearness pay +dearness allowance) shall be contributed by the employee per month towards this scheme& equal amount is contributed by the Govt.

(RB LNo. (NG)2/2004/CL/16/POLICY dt. 17.09.04)

There exists Two Tire under the scheme viz

1) Tire- I : It is compulsory scheme to all employees under which 10% amount of the ( basic pay +dearness pay +dearness allowance) shall be contributed by the employee per month towards this scheme & equal amount is contributed by the Govt. The scheme is non-withdrawal with permanent lock in period till exist from the scheme.

2) Tire II : The scheme is based on Voluntary contribution. Unique 16 digit PRAN : The unique PRAN (Permanent Retirement Account Number) will be allotted to all employees for identification.

Exit from scheme : On exit from the scheme on the following ground, the employee/family/dependent will be paid pension as per the value based on investment option -

i) On Superannuation : 40% of the contribution balance in the account will be refunded & 60% will be invested in the financial institutions appointed by PFRDA, based on which the pension will be paid.

i) On Superannuation : 40% of the contribution balance in the account will be refunded & 60% will be invested in the financial institutions appointed by PFRDA, based on which the pension will be paid.

ii) On Voluntary Retirement : 20% of the contribution balance in the account will be refunded & 80% will be invested in the financial institutions appointed by PFRDA, based on which the pension will be

paid.

Govt. has appointed NSDL (National Securities Depository Limited) as Fund Manager for investment of money based on the option submitted by individual employee

Based on the report of HLTF (High Level Task Force Report) payment of pension to employee appointed on or after 1.01.2004 & who are Discharged on INVALIDATION GROUND / Disablement & to the Families of such employees who have Died during service since 1.01.2004 including Retirement Gratuity/ Death Gratuity/ Extraordinary Family Pension/ Disability Pension etc.

(RB LNo. 2008/AC-11/21/19 dt. 29.05.2009)

COMPLIMENTARY PASS

This pass shall be granted to retired Railway servant for self family members & dependent widow mother of the same class for which employee was entitle while in service.

The facility of companion in lieu of attendant can be granted to IA & I class pass holder above 65 years of age if no any other family member below 65 years of age is included in pass.

WIDOW PASS

This pass shall be granted to widow of Railway servant after his death of the same class for which employee was entitle.

The widow of those Railway servant who were in service on 12-3-87 and opted for the scheme & those who entered Railway service on or after 12-3-87 shall be eligible for widow pass.

50% of post retirement complimentary pass for which employee was in receipt shall be granted to widow. In case of death while in service the date of death shall be assumed as date of retirement notional for calculation.

In case of death while in service if service rendered by the employee falls short than the prescribed service for post-retirement complimentary pass in such a case also widow shall be eligible for one set of pass in alternate years.

This scheme is also applicable to widower in case of death of male Railway servant.

COMPOSITE TRANSFER GRANT

On retirement Railway servant shall also be eligible for composite transfer as applicable in case of transfer.

A) HQ to other place at a distance of 20 kms or more

i) Railway servant who have joined service on or after 1.05.76 shall be eligible for one month’s basic pay & if these employees transport their personnel effects by VPU the CTG will be admissible at the rate of 80% of basic pay if no car is carried.

ii) In a case of employees who joined Railway service prior to 1.5.76 & are entitled for liberal scale of transportation of personnel effects by Railway the quantum of CTG will be,

Group A, B & C - 80% of basic pay.

Group A, B & C - 80% of basic pay.

Group D _ 90% of basic pay.

B) HQ to other place within 20 kms or within same city/ urban agglomeration. 1/3 of the one month’s basic pay.

Note: change of residence must be involved.

No claim for composite transfer grant will be entertained until & unless the retired Railway employee vacates the Railway accommodation allotted to him.

CTG will not be payable to the retired Railway servant if he prefers to stay in the Railway accommodation regularized in the name of his family member after his retirement but if he prefers to live away from his family member in whose name the Railway accommodation has been regularized the CTG will be payable subject to condition of submission of documentary proof of change of residence.

A Railway servant who has joined Railway service prior to 1.5.76 may exercise on option to transport luggage by Railway on the same scale as admissible to Railway servant appointed on or after 1.5.76. The option may be exercised along with the application for kit passes for transportation of personnel effects.